Ever since its took-off in 2021, blockchain-powered games offered an entirely new economic dimension to the gaming experience.

Previously referred to as “play-to-earn”, GameFi enables gamers to earn digital goods for their in-game activities via missions, trade, and other techniques. Although traditional games typically encourage players to accumulate and exchange digital assets, the value of these – sometimes scarce – items are seldom allowed to be actively traded for real-world currency.

That said, in the world of GameFi, valuable in-game items are saved as assets on the blockchain and trading them for crypto (which can be exchanged for Fiat!) is actively encouraged, enabling users to earn tangible rewards for their time invested.

As we head into 2023, here are the top 5 trends to watch for in the crypto gaming industry. Revolutions will happen radically in the industry from technology, user experience, business model and more.

And these trends will shape the future of blockchain gaming. So if you're a developer or gamer enthusiast into web 3.0 gaming, make sure to keep an eye on these exciting advancements!

Trend 1: Crypto Games Going Mobile

Mobile gaming will give rise to the biggest products in Crypto, by improving key user experience and in-app purchase flows.

In 2022, we saw many cases of blockchain ecosystems taking bets on phone manufacturing and mobile infrastructure building. Public chains like Solana and Polygon are releasing new products that aim to make it easier for developers to build decentralized applications on mobile.

Furthermore, a crypto-native and Ethereum-based operating system is already in beta supporting a variety of blockchain features. We can expect to see more innovation like this in the near future.

Zooming into the games sector, console games have long been the denominator, but we’ve observed a huge market void for engaging crypto gaming experiences on mobile. At present, there are more than 1700 projects listed on chainplay while only 30% of them support Android or IOS. The migration of web3 games to the mobile terminal has not yet been officially kicked off.

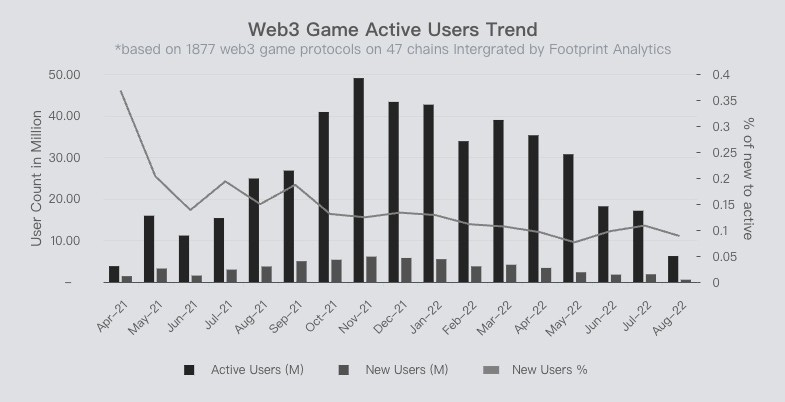

Developing apps natively on mobile caters the need for crypto games to be massively adopted. The gaming industry is worth over 100 billion, with mobile games accounting for over 50% of the revenue. Compared to that, the current GameFi market value is only 6 billion and growth in its user base has stagnated for the past quarters since the beginning of the crypto winter.

One key advantage for mobile native crypto games is to leverage the existing distribution channels, and therefore speaking to the greater gaming audience. In order to achieve that, there are gaps to be filled in the current P2E project’s user experiences.

To attract more general gamers, crypto games on mobile have to improve the key user experience steps such as onboarding and in-app purchase flows to increase the adoption of Crypto games and dApps.

Trend 2: Geographical Divergence

South East Asia, South America and Africa will give rise to the biggest player communities and medium-sized game studios, Mature markets like Japan and Korea will have their own gaming chains powered by large incumbents

In 2023, we expect to see a clear divergence between emerging gaming markets and mature gaming markets in the development track of crypto games.

We forecast that the biggest player communities and medium-sized web 3.0 game studios are forming in emerging markets, while mature markets like Japan and Korea will have their own gaming chains powered by large incumbents.

Take Africa as an example. It is a promising continent for crypto game development due to its young population and rising digital literacy rates. Several countries in Africa rank high on a global crypto adoption index.

In addition to that, a survey in 2021 found that 9.4% of South Africans intend to purchase NFTs in the near future, with NFT adoption expected to reach 17.8% in the near term. This indicates that Africa is poised for continued growth in the crypto gaming industry while NFTs and cryptocurrencies will play a major role in this growth.

Another emerging market for video games to be reckoned with is south-east Asia. With an estimated compound annual growth rate (CAGR) of 8.6% between 2020-2025 for video game revenue, Southeast Asia is one of the fastest growing games markets in the world.

Just like south-Africa, the booming of south east Asia’s gaming industry is largely due to the region's young demographics and their demand for games, as well as the tolerance for innovation in the gaming field.

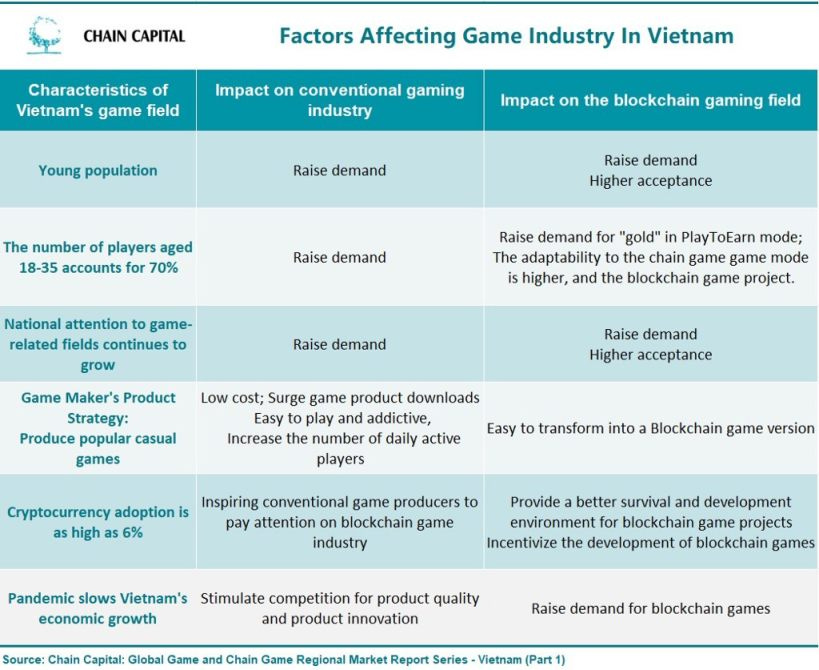

As one of the leading countries in games innovation in the region, Vietnam has a gamers’ population with only 30.1 average age. Local players in Vietnam continue to pay attention to games and related industries in 2022, with mobile game users, console game users, and PC game users all experiencing growth.

Meanwhile, game-related industries in Vietnam are also seeing increased attention, with the number of audience watching game streamers and attending eSports events both experiencing significant growth.

For game companies, this indicates a sustainable enthusiasm for games that is motivating developers to create new and innovative content. Additionally, the adoption rate of crypto-currency in Vietnam is high, with 6 million people (~6% of the population) owning crypto assets. This makes Vietnam, and counterparts in south-east Asia, promising markets for the development of blockchain-based games for domestic adoption.

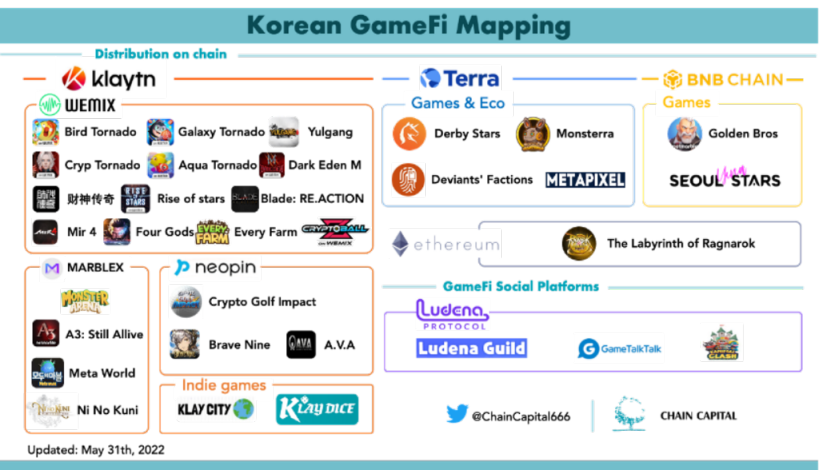

Looking into the more mature gaming market like Korea and Japan, there are a lot of different stories to tell. The Korean Gamefi ecosystem is dominated by three local public chains: WeMade, Netmarble, and Neowiz.

These companies have created their own game ecosystems/sidechains, which account for around 80% of the market. There are also a few smaller companies that have developed their own games and gaming platforms, including BSS Studio (KlayDice), Npixel (MetaPixel), and an independent team (Ludena Protocol).

Similarly, in Japan, the leading game manufacturers are accelerating their process in GameFi and Web 3.0, with many of them establishing their own crypto labs or chain game studios to develop crypto games.

Plus, Japan has been a leader in regulating and taxing blockchain-related industries. With prograssive tax rate ranging from 15% to 55% and strong regulations filters only regulated and qualified GameFi projects from Japan and can prevent small to medium sized gaming studios from competing in the domestic market.

Trend 3: Easier Onboarding

More games will have their in-game wallet and social login, instead of replying on EOA (Externally Owned Account) accounts

As a prerequisite step to mass adoption, we will observe more crypto games design and integrate their own wallet authentication process. In other words, products and user experience has to be blockchain-agnostic enough to give the highest conversion out of the onboarding process.

Many of the projects in the Gamefi 1.0 era use EOA (Externally owned Account) to authenticate their gamers. One of the benefits of EOA is that there is no central authority to censor or block you from using the system.

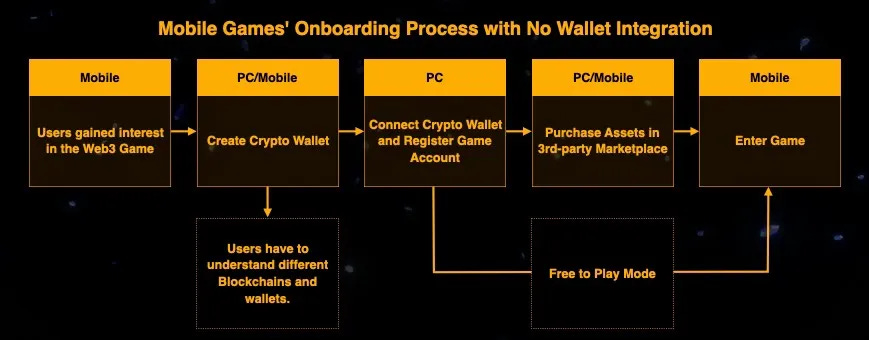

However, this also means there is no central authority to turn to when things go wrong. In-addition, EOA authentication always involves a more complicated authentication that involves pop-ups or jumping out of the application. Consider a typical EOA on-boarding process demonstrated below as an example,

EOA wallet has posed a severe challenge for reliable, secure and seamless onramp experience and it somehow prevents more decentralized applications, especially in niche like crypto games that emphasize un-interrupted experiences, from mass-adoption.

GameFi projects that use EOA to onboard users are like walled gardens that stopped the mainstream from learning how wonderful their games were. With more innovation, development and well as capital flow into infrastructure building, we will expect to see more projects adopt their own in-game wallet authentication that lowers user access barrier.

Trend 4: New Distribution Channels

Blockchain gaming adoption will drive channel payment fees down; New distribution channels will rise outside of App Store and Google Play

High channel fee payment to centralized application stores such as Apple Store and Google play has long been denounced and even raised legal issues. In August 2020, Epic Games filed a lawsuit against Apple stating that Apple's practices in the iOS App Store were anticompetitive.

Specifically, Epic Games challenged Apple's restrictions on applications from having other in-app purchasing methods outside of the one offered by the App Store. As part of the suit settlement, Apple has changed their policy to allow app developers to email their users about alternative purchase options.

Adoption of blockchain gaming has offered another solution for game developers to avoid distribution channel fees. Currently we saw very few web 3.0 projects are willing to pay 15% to 30% of their gross sales to application stores.

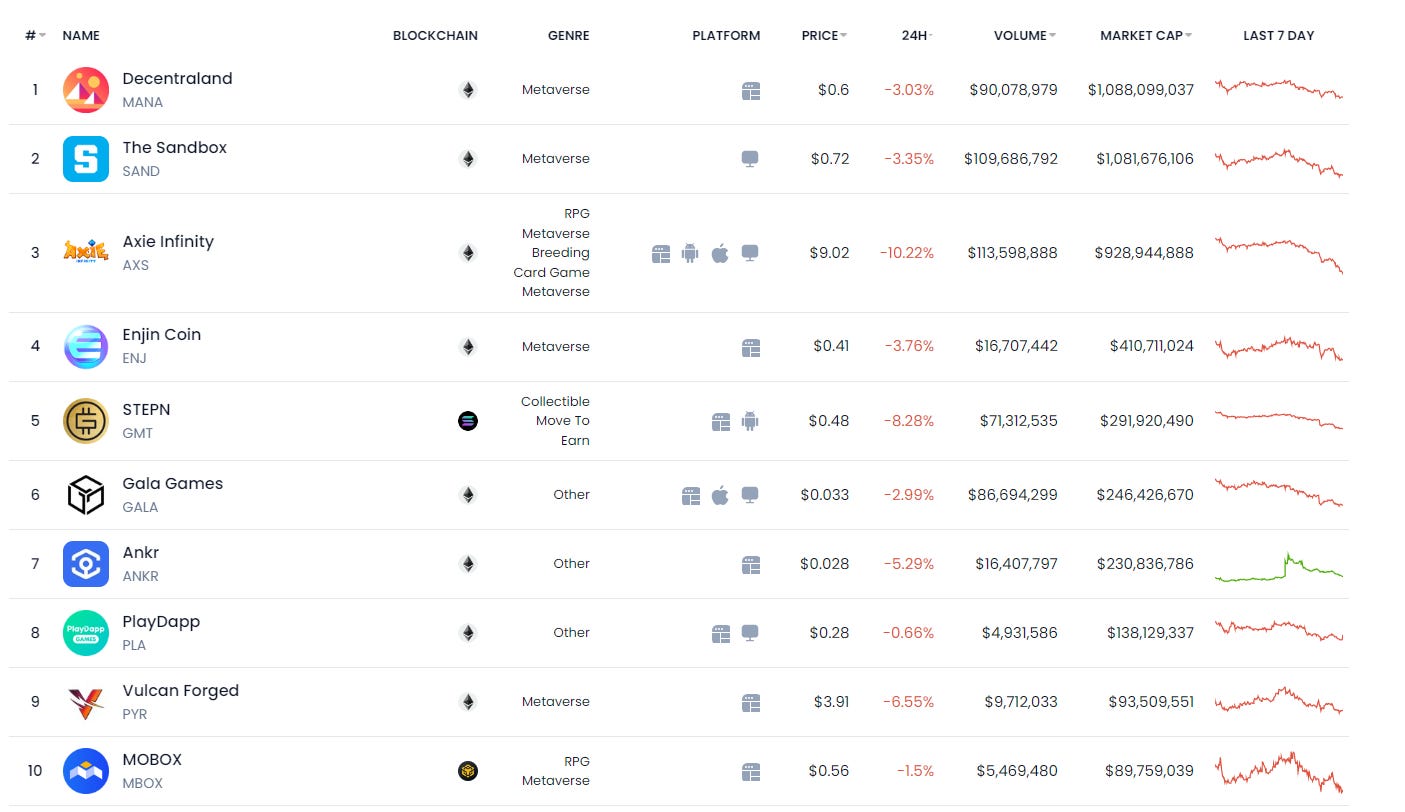

More and more of them are building their own storefronts and leveraging crypto payments options. The STEPN team, a move-to-earn project, sets a standard of a brand new marketplace experience as it announced its browser version of the marketplace.

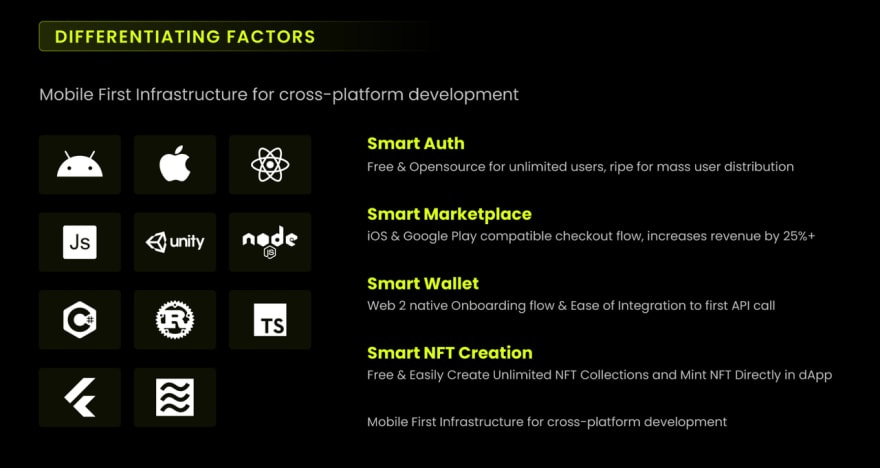

While it can be harder for smaller projects to develop such integrated features like STEPN did, there are cost-effective infrastructure providers that offer toolkits to allow for cheaper on-ramp and checkout experience.

Trend 5: New Business Models

New business models emerge and Less projects will be "play-to-earn" and more will be "free-to-play". In-game sales will still be the main revenue stream for most projects, despite a small percentage of projects' large secondary volume.

According to the gamefi report by chainplay, 58% of investors worldwide stated that “Poor In-game Economy Design” is the number one reason for declining GameFi profits in the last six months. So what is wrong with most Gamfi’s economy design?

In the traditional P2E (Play to earn) mode, gamers will need to purchase assets (NFTs) before entering the game. Key revenue sources for previous P2E projects rely heavily on asset-purchase, in-game consumption and secondary market sales.

Most users are attracted to such a mode with the only goal to break even, and many of them leave right after they earn some fortune, in fear of the game economy collapsing competently before they exit. With problematic user profiles, many game economies break down.

In 2023, we would expect to see a transition from P2E to F2P (Free to Play) for most crypto gaming projects. We firmly believe that this transition will be the building block to bring crypto games to mass adoption.

In a F2P mode without asset sales, how can game studios make money? The key here is to increase revenue through in-app purchases. With easy on-barding and seamless on-chain translation, in-game sales would be made possible.

Therefore, asset sales will still be the main revenue stream for most projects, but it’s now taken into the game and the revenue comes from gamers who really liked the game but not those who want to break even.

We also expect to see more projects taking token incentives outside of the game’s economy loop, allowing users to focus on the entertainment while embracing ownership of their digital assets by being able to trade seamlessly with a beautifully built marketplace. Afterall, that’s what blockchain has empowered gamers, not monetary earnings.

If you are interested in Mirror World Smart SDK, please check the following links:

Website: https://mirrorworld.fun/developer

Twitter: https://twitter.com/mirror_matrix

YouTube: https://www.youtube.com/channel/UC9NkOWpL_b2kotDBmtE98dw