The Current Situation, Dilemma, and Future of Crypto Wallets

Offering some new perspectives that one should take on crypto wallets

Original article by BuidlerDAO

Paradise for Web 3.0 developers, researchers and learners. Move over HODL, it's time to BUIDL!

Read More About Buidler DAO Here

There are several runaways in the crypto world that stubborn retail investors favor yet often return with empty hands: Wallet, Privacy, DAO.

These runways often endure high expectations from retail investors, but none of these runways has emerged a unicorn project so far, especially for crypto wallets.

After these two cycles, a couple of in-n-outs, and ecosystems filled with emptied wallets, still, some remained stubborn.

As a senior retail investor, I will try to rethink the current situation, dilemma, and future of crypto wallets without considering my current investment positions, traditional conceptualizations, or the outdated retail investor mindset.

The Current Situation

Low market value. Crypto wallets did not live up to the hype.

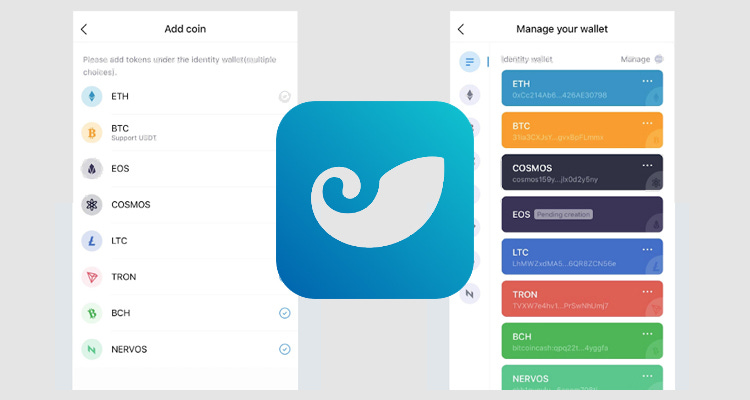

For ordinary blockchain users, the most common mobile applications they use are the decentralized exchanges app and wallet app. And that is where most of the user's blockchain assets are stored and presented.

As of now, amongst the assets with the Top 20 highest market values, only one of them is the decentralized exchange asset (namely BNB) and 0 wallet-related assets was ranked on top. If we zoom out to the Top 100, the decentralized exchange asset occupied 5 of them, still with 0 wallet-related assets in the list.

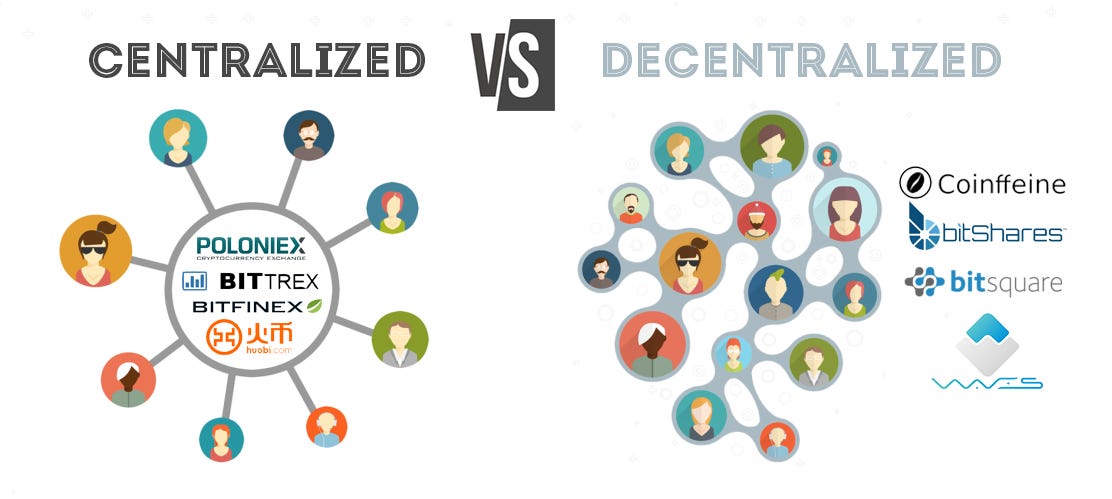

As an industry under constant regulations, centralized exchanges are the primary target of supervision. 1

Whenever such fake news or "inside information" appears, the first thing investors do is withdraw their assets from centralized exchanges to their wallets.

In the old-fashioned industry concept, the wallet "stores" assets means that assets are put on the chain. Since we hold the private key of the wallet, it feels more reliable to store assets in our own wallet than in centralized exchanges.

This explains why wallets are so essential to general users, they need something to generate address , backup, transfer, inquiry, and display of crypto asset.

For example, during the 2017 "94" regulation incident, Imtoken quickly became the most widely used wallet by global users. A large number of centralized exchange users (Huobi, Okex, Bitcoin China, etc.) transferred their assets to wallets to avoid the potential loss of assets caused by the exchanges’ closure.

Based on this, Imtoken quickly accumulated users and established its industry position for the next two years, becoming the most trendy company at the time. Soon after, IDG led the A-round investment of Imtoken.

The general usage and importance of wallets in the industry seem to be a consensus and are visible to all. Given the unanimous consent, the market value of wallet applications seem to be seriously underestimated and signify a good reason to buy in.

However, unfortunately, the market has not given us the expected feedback, and the market value of wallet projects has always been sluggish.

The Current Situation

Crypto Wallet has been taken advantage of as giants’ tool

In simple terms, let’s look at a group of past financing information:

In June 2016, Imtoken received angel round financing from the traditional institution Tisiwi; subsequently, IDG Capital led its A round financing.

In June 2017, Blockchain obtained $40 million in B-round raise.

In April 2018, TP Wallet completed several million dollars in angel round financing.

In August 2018, Binance announced the acquisition of wallet provider Trust Wallet.

In May 2020, Binance announced an investment in wallet provider Safepal.

In December 2020, Math Wallet completed B-round raise led by Binance for $12 million.

In November 2021, Coinbase acquired wallet provider Breadwallet.

Before 2018, financing for wallets was mainly from institutional investors. After 2018, it was mainly from top centralized exchanges acquiring and investing.

The reason for the change is not hard to understand. As the number of cryptocurrency traders and the scale of funds exploded, exchanges became absolute industry giants, with a huge amount of capital to buy around.

For the sake of their own benefits, the platform has enough motivation to maintain and strengthen its monopolistic advantage and position.

At the same time, the blockchain industry itself has also been developing rapidly in recent years. In the past, the "trading" of the secondary market was the only demand and scenario in the industry. But now, with the rise of DEX, Defi, NFT, Gamefi, and SocialFi, the user scenarios are no longer limited to secondary tradings in centralized exchanges.

Users can choose to withdraw assets to the chain (wallet) to play with various interesting and profitable applications, protocols, and financial products, and the demand is strong. The wallet is now the best carrier of the industry's new needs and scenarios.

If central exchanges do not change and stick to CEX, there will inevitably be a large amount of user and capital outflow.

Spending money on acquisitions is the most cost-effective and efficient way for top centralized exchanges. Under the multi-chain structure, wallet serves as the entrance step of the acquisition funnel, and had undoubtly become the object of acquisition and strategy investment by top institutions.

For wallet providers, it is difficult to say that they are not moved by the opportunity for realizing their personal wealth after being acquired, given the dilemma of making a profit only through wallet services.

Dilemma

Why is it that wallets are clearly important, but difficult to be profitable and capture value?

In my opinion, the core is that although the wallet is called a "wallet", it is not essentially related to the user's on-chain assets.

The business model of the exchange is clear. transaction fees, new coin listing fees, staking, market making, primary-secondary incubation, wealth management, mining pools, etc., it can be said that centralized exchanges can make a profit in any way we can or can’t think of.

The exchange is like a large pond, sedimenting real users and assets. With a large amount of assets in the exchange, as long as the exchange provides a possibility of making money, users will operate their own funds to use and gamble for it.

If a user wants to withdraw, the exchange can even suspend the audit, freeze the account, etc. In other words, the exchange has a strong relationship and is in a dominant position over the user's assets.

The biggest difference between wallets and exchanges is that, in essence, wallets do not really sediment users' assets.

Although users' assets are in the wallet, they are not really "in" the wallet. Instead, they are on the chain. The wallet only provides users with a way to manage their assets on the chain.

Because the assets are on the chain, they are completely controlled by the user. Users can use one wallet to display, or they can use another, and there is no threshold or barrier to switching between them. It is even harder for the wallet to organize the behavior of how users are going about transferring their assets.

Users have the lowest friction and the freest control over assets when they operate assets in the wallet. The problem this brings is the wallet’s weak relevance to the user.

Of course, we also see that many wallets have also been trying to break through such difficulties, such as launching asset management products, trying to oursource security solutions to other businesses, opening up information services, selling advertisements, and even selling hardware wallets, etc.

But many of them are mediocre that cannot make a lot of money or cannot capture value in an effective way by creating sustainable competitive advantages and barriers.

Future of the Wallet

Users use wallets because wallets are safer than exchanges and allows them to have stronger control over their assets. If the logic of exchanges is used to think about the direction of profits, it may be a mistake from the beginning.

Here we try to classify users according to their trading preferences, which can generally be divided into: token traders, currency hoarders, and application surfing users.

Token trading users care about liquidity and have a high trading frequency. These users like to keep their assets on exchanges and are ready to buy and sell at any time.

Currency hoarders, on the other hand, have a low trading frequency and care about the safety of their assets. Once they buy, they will not sell in the medium to short term. After buying, they are used to withdrawing from the exchange to the wallet or even to the cold wallet. This type of user usually has a large amount of funds.

The application surfing user likes to try various new applications and concepts, such as the latest web3, metaverse, defi, GameFi, NFT, etc. They may also participate in the donation and crowdfunding of some early DAOs. This type of user has a high frequency of using wallets and longer use-time of the wallet.

Of course, these three types of users are not constant, they are sometimes exchangable, and sometimes they exist on the same user at the same time.

From the perspective of how user changes in general , I think as the overall performance of the blockchain improves, on-chain applications will become more abundant, and the number of application-surfing users will continue to increase. Even if secondary market trading is still the largest proportion in the future, the overall upward trend is clear.

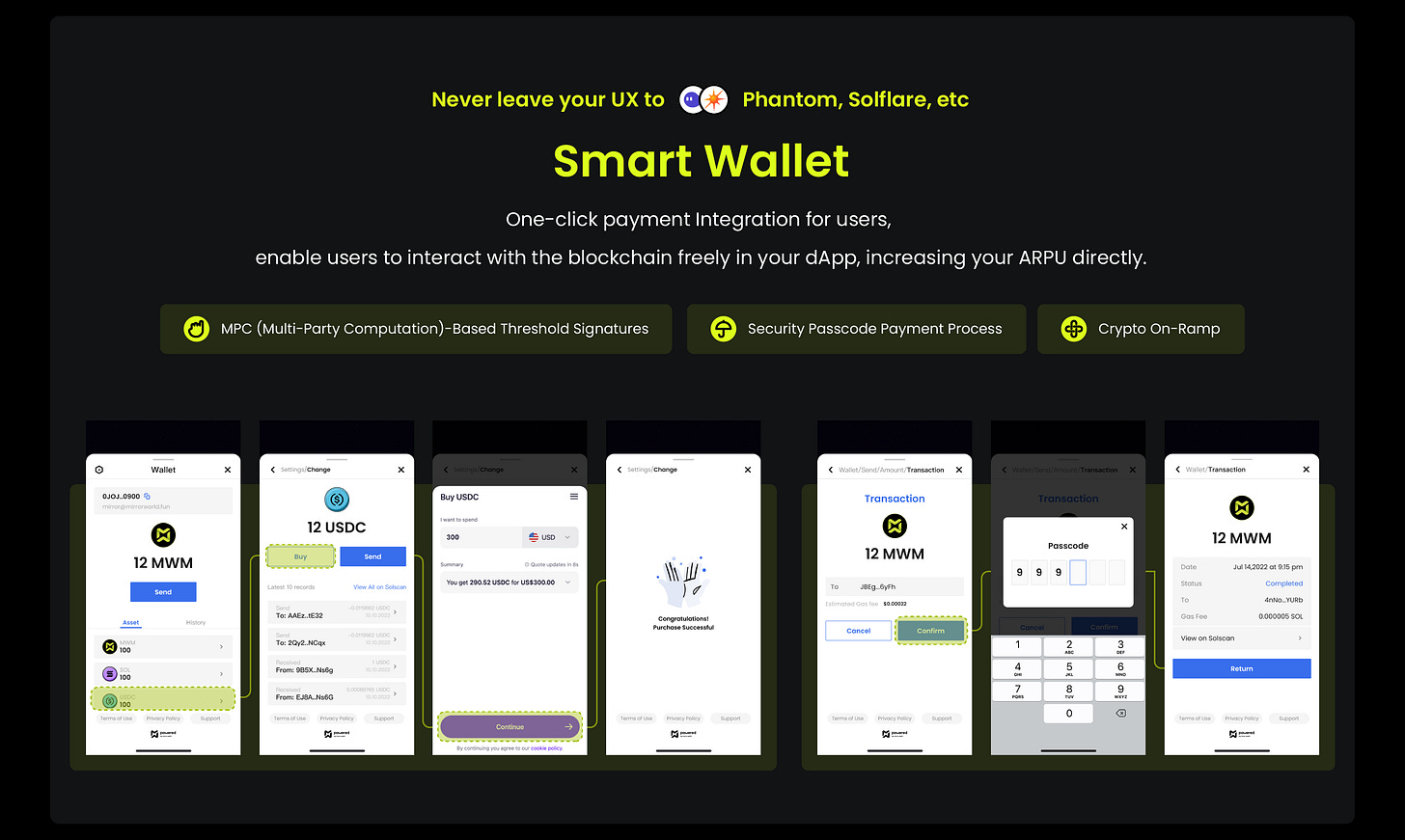

Wallet as a widely used user entry point, it is worth exploring continuously serving app-surfing users. Wallets should abandon focusing on user assets and instead focus on user behavior, creating solutions around the web3 and meta-universe needs of users.

These users currently have a lot of unmet needs, such as how to prevent phishing app deception, how to identify suspicious authorization, and how to identify misleading zero-width characters. And also how to quickly view chain data, various warnings, the latest developments of whales, etc.

These needs can be listed several pages long. Not every need needs to be met by wallets, but they can selectively meet user needs to explore a closer relationship wallets have with users, and with user assets.

Looking further into the future, blockchain will inevitably become popular and common. Once it is widespread, users will not need to know what underlying chain their device is using; this is not necessary and not what users are most concerned about.

All chains will be sufficiently secure and smooth, and what users need is a friendly entrance to find their favorite applications. All applications, whether they are on multiple chains or a single chain, make up the entire application ecosystem where users can surf endlessly and realize various possibilities of the metaverse and web3.

What users need is only a convenient and unified entrance. With a wallet in hand, web3 is all yours to explore.

Standing in the future form of wallets and looking at the present, maybe the term "wallet" is not appropriate and can easily lead to limitations and misunderstandings.

Once I have a friend in the wallet industry argued that wallets should insist on being simple, clean, and only having a single function because the core purpose of wallets is to provide asset storage services for users. Only in this way can it become an Alipay for encrypted assets.

This should be the stereotypical thoughts of most people about wallets. Wallets should be the counterpart of Alipay on web3.

However, wallets may never become Alipay, because these are two completely different asset forms, and the flow of their assets are in completely different ways.

Users do need a wallet, but they do not only need a wallet. What users need is a tool for displaying and transferring assets on the chain. As for tools, they may be useful, but they do not necessarily have independent value.

When wallets become tools, whether they are backup tools for top exchanges or tools for displaying user assets, they do not have high valuation potential. However, the "wallet" that has the potential to become the entrance of the future metaverse, web3, may be the "wallet" that we dream of, with valuation potential similar to that of exchanges.

As for how to become such a future entrance, I currently do not have a clear idea. It may be:

The wallet becomes a DID identity system, managing wallet addresses on various chains with a unified identity system.

The wallet becomes a reliable and secure web3 access portal through its powerful tool development capabilities.

Investing and incubating to create phenomenon-level applications, and letting applications drive traffic back to the wallet.

Positioning as a portal and app store, rather than an asset tool, and focusing on meeting users' diverse needs.

This is an open question. If you keep an eye on the development of wallets in this general direction, you may be able to capture some opportunities at the end.

If you are interested in Mirror World Smart SDK and looking to make a wallet of your own right now, please visit:

Our Developer Dashboard: https://mirrorworld.fun/developer

Previous Articles By BuidlerDAO

We have marked the source of all the non-royalty-free pictures, if you would like us to withdraw the picture, please let us know through any contact from above.